Connecting Investors and Businesses: MDD’s Crowdlending Platform in Saudi Arabia

In an increasingly competitive financial landscape, start ups and real estate developers are seeking innovative ways to secure funding without sacrificing ownership or control of their assets. MDD offers a solution through crowdlending, providing access to a new source of financing tailored to support growth for small businesses and real estate developers in Saudi Arabia.

Crowdlending, also known as peer-to-peer lending, connects businesses directly with investors, allowing them to bypass traditional banking channels. This approach enables companies to secure loans from a pool of investors, making the process faster, more flexible, and often more favorable than conventional financing methods. MDD Fintech specializes in matching businesses with investors, making capital more accessible and facilitating projects that drive economic growth in the region.

For investors, MDD offers an exciting opportunity to diversify your portfolio. By participating in crowdlending, you can access a range of investment opportunities across various industries, all while earning attractive returns. With MDD’s carefully curated projects, investors can spread risk and tap into the growing potential of Saudi Arabia’s dynamic business landscape.

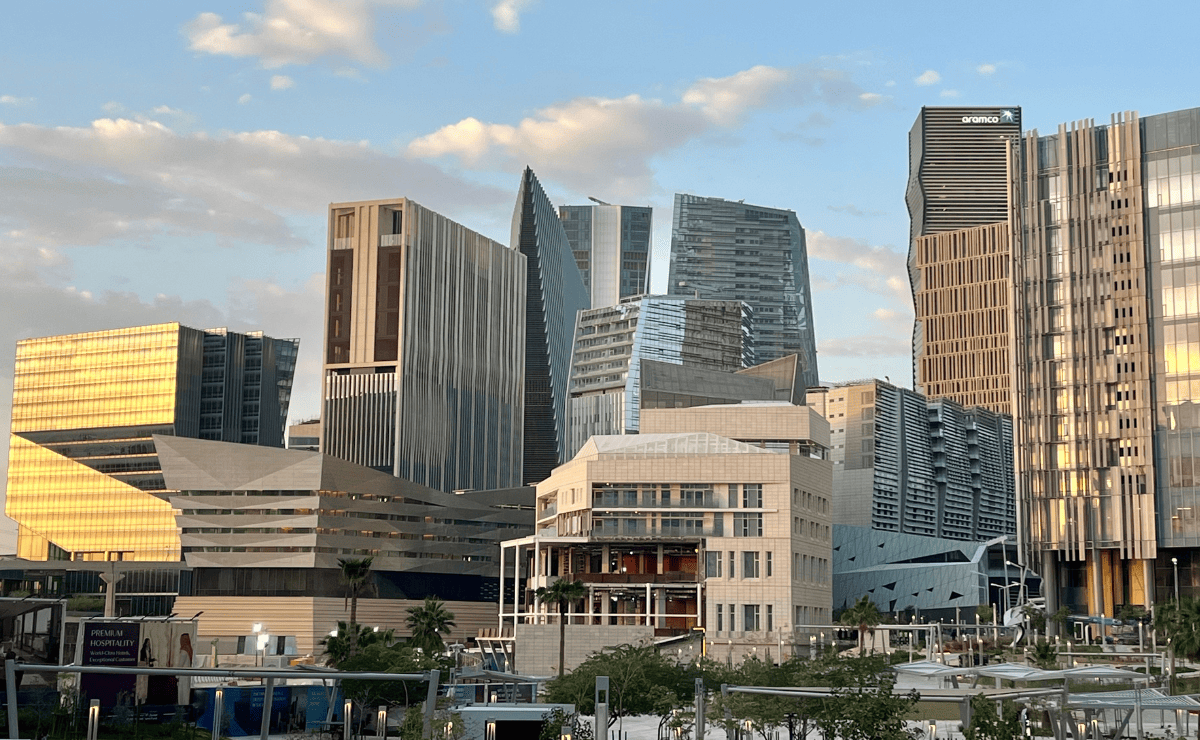

Licensed by the Saudi Arabian Financial Supervisory Authority, MDD Fintech operates as a trusted, Sharia-compliant loan intermediary. MDD offers a variety of loans and financing solutions designed to meet the unique needs of those seeking investments. Whether you’re looking to expand operations, develop new projects, or scale existing ones, MDD provides the tools and support to help you reach your goals.